What is Debt Consolidation?

Having a credit card and some store accounts helps in buying luxury expenses, and one pays towards these every month. And one day, an unexpected expense strives, and one has not enough to cover the cost of the payment, and the loan may increase and suffer a financial strain. That is where debt consolidation comes into play and a good debt consolidation company can help you.

One knows how he/she can repay the loan into a single loan to make more manageable repayments. By paying the loan for the longer term with longer Interest but at lower monthly rates and eventually live debt free in New York City.

Debt Consolidation

Note: Debt consolidation loan does not repay the original loan. They transfer the loan into a different lender type of loan.

Types of debt consolidation

There are two types of debt consolidation: Secured and Unsecured Loans.

-

Secured loans

As far as secured loans are concerned, these loans are backed or guaranteed by any asset or collateral of the borrower, attached as a mortgage.

The risk of default in the secured loan is pretty much less as your collaterals. Assets can be used against the borrower, and you get a lower amount of loan that your assets are worth.

Because of the low default rate, such secured loans are meagre as the chances of default are relatively less.

But in case of default, the Bank has your collaterals and assets and through selling your assets bank recovers all the dues (loan + Interest)

Moreover, secured loans take a bit of time to get approved as there is a lot of documentation is required for mortgaging your assets as collateral.

Examples of secured loans include Home loan, Car loan, loan against property, Gold loan, Inventory loan, business loan, loan against machinery.

-

Unsecured loans

As far as unsecured loans are concerned, they are not backed or secured by any collaterals or assets. The risk of default in unsecured loan increase as it is an unsecured loan. So the risk for Bank is very high, and because of that, the interest rate of an unsecured loan becomes very high.

But in case of default in unsecured loans, the lender does not have any assets or collateral of the borrower. Banks have no other option but to write off the loan. And being a borrower, your credit scores affect which may affect your future loan activities.

Moreover, unsecured loans are approved very quickly. You don’t have to do any documentation work, and banks do not need your assets as a mortgage.

Examples of unsecured loans include Education loans, Credit card loans, Student loans, personal loans, unsecured business loans, bank overdrafts.

Is debt consolidation a good option?

The answer to this question is YES. If you are looking for a long term and higher amount of loan, then you should proceed with a secured loan, but for a shorter period and lower amount, an unsecured loan is the best option but only in case of emergencies.

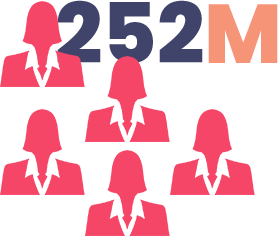

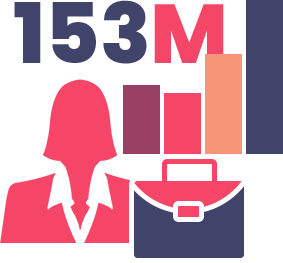

[…] credit card debt consolidation is almost equal to the total credit card users. Prime reasons for debt consolidation are consumer loans (35%), household expenses (19%), and medical expenses […]

[…] For more articles, click here. […]

[…] To read more such articles, click here. […]