What is a credit score?

A credit score is a predictive analysis used by lenders and financial firms to assess the creditworthiness of an individual or a small, owner-operated company. Lenders use credit scoring to help them determine whether to grant or reject credit. Credit scores influence many financial transfers, such as deposits, vehicle loans, credit cards, and private loans.

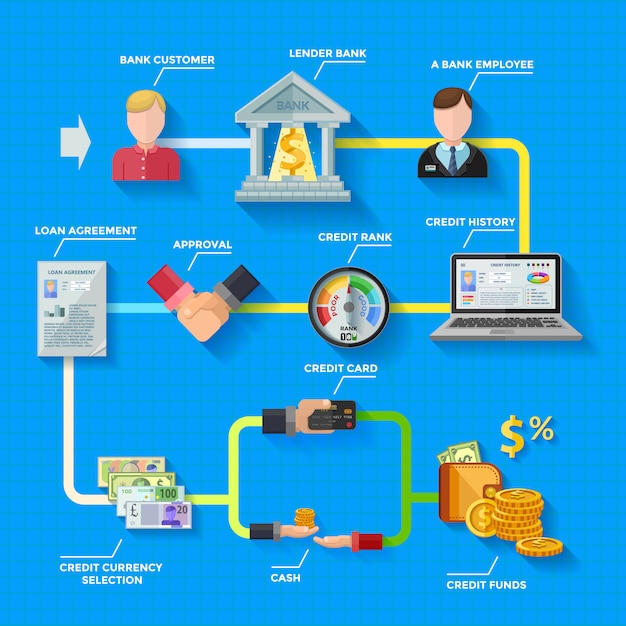

Source: freepik

Why is it so important?

A credit score is a three-digit number that indicates how creditworthy you are. When you apply for a loan or a credit card, it is the first thing lenders look at. It gives them an indication of whether you will be able to repay the loan on time or not. As a result, maintaining a decent credit score is critical.

You can use extraordinary scores into incredible arrangements — on advances, Mastercards, protection charges, lofts, and wireless plans. Terrible scores can pound you into passing up a major opportunity or paying more. The lifetime cost of higher credit fees from awful or fair credit can surpass six figures.

Since credit ratings have become a particularly essential piece of our monetary lives, it pays to monitor yours and see what your activities mean for the numbers. You can model, guard and use great credit paying little mind to your age or pay.

How do Credit Scores work?

Source: Unsplash

The vast majority do not have one score; they have many, and the scores change constantly.

Credit scoring styles ranging from 300 to 850 are the most widely used. Each lender establishes its own criteria for determining what constitutes a good credit score. However, ratings generally fall into the following categories:

- A credit score of 720 or higher indicates excellent credit.

- A good credit score falls in the category of 690 to 719.

- A credit score of 630 to 689 indicates fair credit.

- Bad credit is described as a score of 629 or lower.

Calculation of the Credit Score:

It is realized that the count consolidates five significant segments, with shifting degrees of significance.

-

Payment history (35%)

The analysis of payment installment history considers whether you have paid your credit accounts reliably and on schedule.

-

The amount owed (30%)

The following biggest segment is the sum you at present owe comparative with the credit you have accessible.

-

Length of credit history (15%)

The more drawn out your credit accounts have been open and on favorable terms, the better.

-

New credit (10%)

When individuals apply for credit much of the time, it presumably shows monetary pressing factors, so every time you apply for credit, your score gets dinged a bit.

-

Credit mix (10%)

Loan lenders like to see a sound credit blend that shows that you can effectively oversee various sorts of credit.

These classifications are important considerations in your general score, which can go from 300 to 850. No one factor or episode decides it totally.

Source: freepik

How to Improve Credit Score?

Keep track of the bills and pay them on time.

By paying all of your bills on time per month, you will have a favorable impact on this credit score metric. Late payments or settling an account for less than you promised to settle will have a negative impact on your credit score.

File a dispute with the credit bureaus whether the credit reports contain inaccuracies.

Your scores can suffer as a result of inaccurate information on your credit reports. Check to make sure the accounts reported on your records are accurate. If you find any mistakes, please contest the details and have them corrected as soon as possible. Regularly monitoring your credit will help you catch inaccuracies before they cause damage.

Pay down debt and keep credit cards and other revolving credit balances low.

Another critical statistic in calculations is the credit usage ratio. It is determined by multiplying the overall credit cap by the amount of all your credit card balances at any given moment. Examine all of your credit card receipts from the previous 12 months to determine your total credit usage level. Divide the monthly statement balances from all of your cards by 12. That is how much credit you use on a monthly basis on average.

Just apply for and open new credit accounts when absolutely necessary.

Unnecessary credit can damage your credit score in a variety of ways, from increasing the number of hard inquiries on your credit report to luring you into overspending and debt accumulation.

Avoid multiple credit inquiries by not applying for too much new credit.

The act of applying for credit causes a hard inquiry on your credit report, so opening a new credit card will raise your maximum credit cap. A high number of hard inquiries will lower your credit score, but this effect fades with time.

Close credit cards if you haven’t used them in a while.

It is a good idea to keep unused credit cards available, as long as they are not costing you money in monthly payments, so closing an account will raise the credit usage ratio. If you owe the same amount but have fewer open accounts, your credit score can suffer.

Earn credit for making on-time utility and cell phone payments.

There is a way to boost your credit score if you have been paying your utilities and mobile phone bills on time.

Source: pexels

Conclusion

Thus, before the bank or the moneylender shocks you with a negative input on your financial assessment, it is prescribed to keep a customary track of it and keep sound reliability. Keep in mind: in the event that you are a guarded borrower, you would score well on your credit value.

Click here for more such finance-related articles.

To know more about the analysis of your credit score, click here.